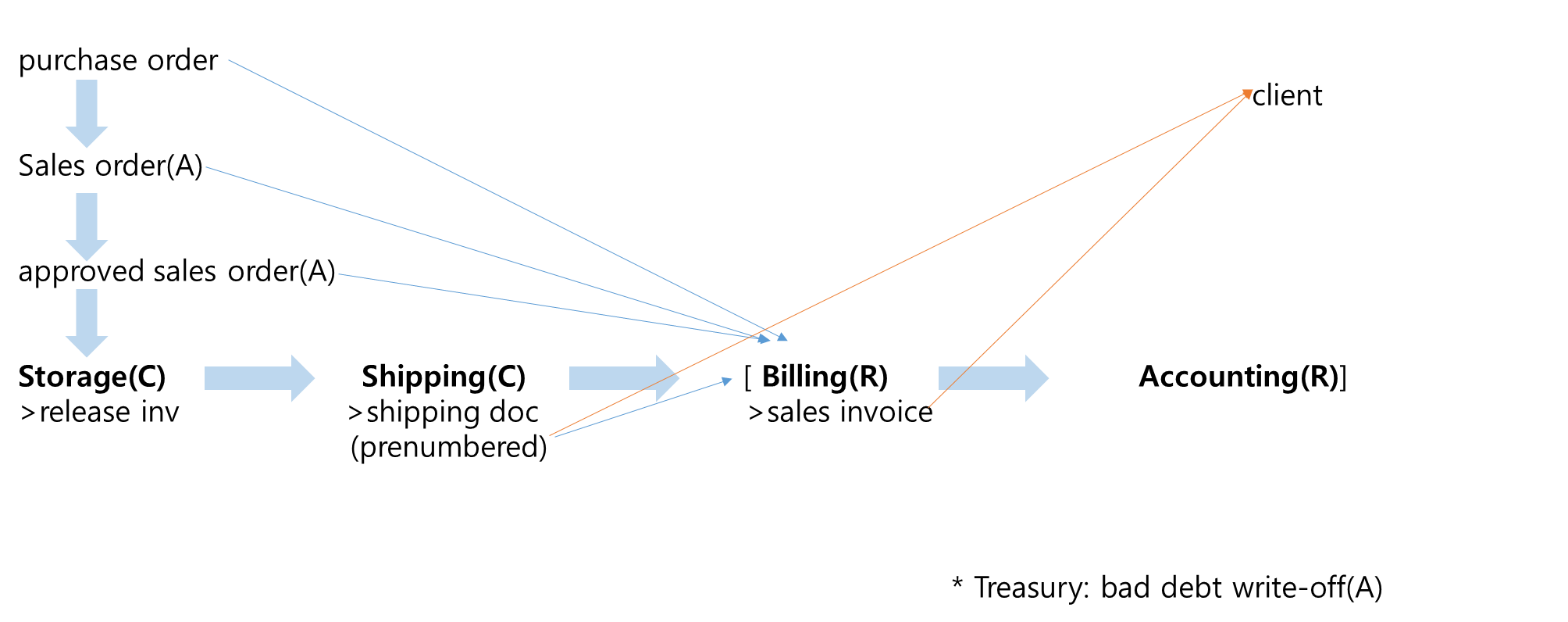

Sales cycle

Cash receipt cycle

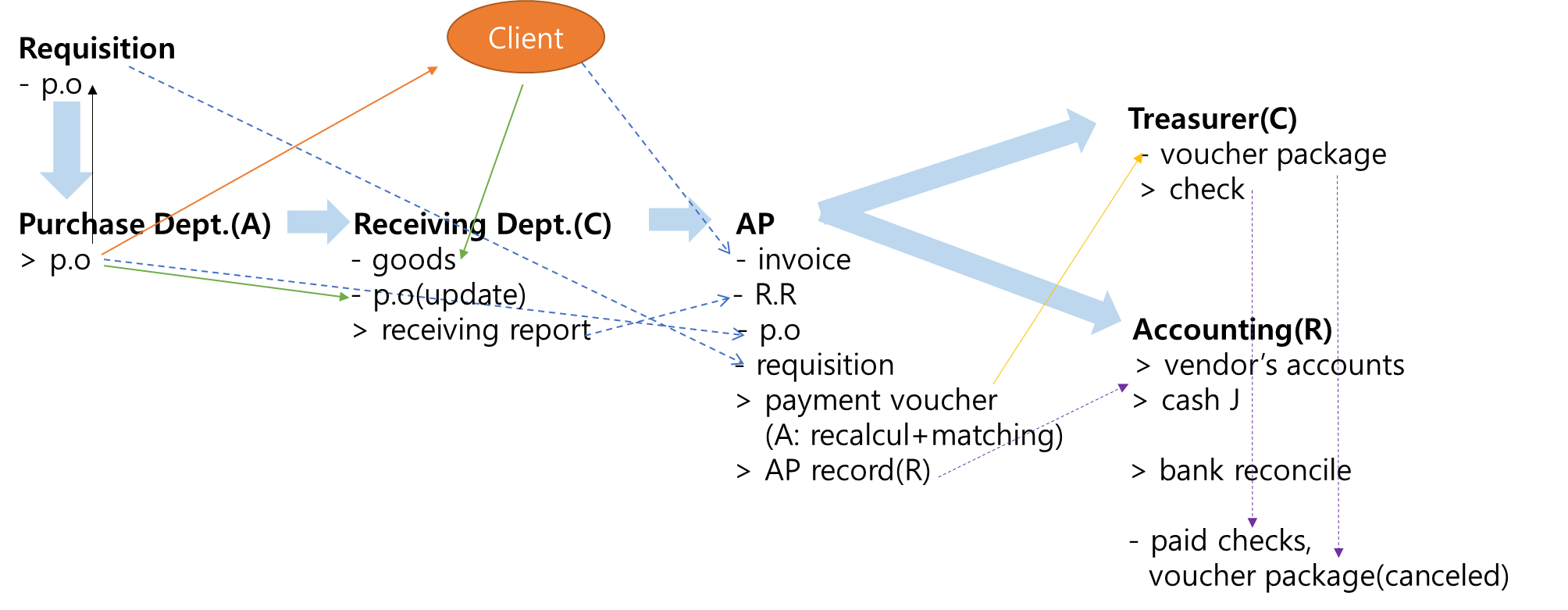

Cash disbursement cycle

Cash handling vs Record keeping vs Bank reconciliation

each prepared by an independent individual

Lapping ( Record keeping + custody of cash)

| Prevention | Detection |

| - segregation of duties - Lockbox |

- Monthly statement - Bank deposit slip |

Sales returns

sales return: received & examined by the receiving department(shipping)

Credit memo: reduce invoice amount, prepared & Approved by not cash custody person(Treasury)

* Debit memo: increase invoice amount

Inventory cycle

Physical control(custody)

Perpetual records(recording)

> periodically compared

unit cost records

standard costing(strong control, valuation assertion)

valuation, allocation, accuracy assertion

> mathematicla computation of the inventory report + reconciling to the inv general leger

> reviewing direct labor rates and testing the computation of the standard overhead rates used

> performing inventory price test

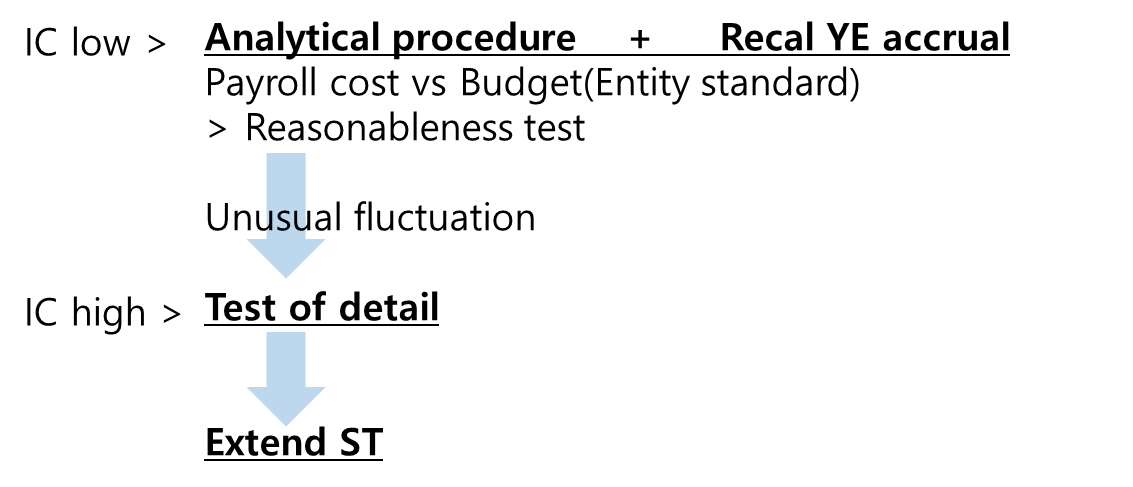

Payroll cycle

Payroll Dept.(R)

- approved time card

- pay rate

> compute wages

> unsigned payroll checks

Treasurer(C)

sign checks

Distribute payroll checks

Fictitious employees(Existence)

| Prevention | Detection |

| - prompt notification - segregation of duties (authorized time card, pay rate) |

- Budget system(independent review) - Observe check distribution on a surprise basis - Vouch pay rate(payroll register > authorized pay rate) - Vouch working time(payroll register > authorized time card) |

* payroll tax form > unpaid tax

* payroll tax = unemployment tax + other tax (calcul each)

* range test : 갑툭튀

'회계 세무 공부 > AICPA 공부 요약' 카테고리의 다른 글

| [AUD] Property, Plant and Equipment (0) | 2024.03.16 |

|---|---|

| [AUD] Investments (0) | 2024.03.16 |

| [AUD] Qualified Adverse Disclaimer modified reports summary table (0) | 2024.03.15 |

| [AUD] Emphasis of matter (0) | 2024.03.15 |

| [AUD] Integrate report and Separate report for non issuer / issuer (0) | 2024.03.15 |

댓글